In the rapidly evolving world of supply chain management, relying on outdated notions or oversimplified strategies can lead to significant missteps. That’s why adapting forecasting methods is essential to navigate the diverse and constantly changing demand patterns effectively.

In this article, we’ll explore why a dynamic forecasting approach is beneficial and necessary for today’s demand planners to maintain accuracy and efficiency. Join us as we dissect demand forecasting myths and highlight the importance of evolving forecasting techniques in an ever-changing business landscape:

- Myth One – One Size Fits all In forecasting

- Myth Two – Complexity Equals Inaccurate forecasting

- Myth Three – Creating an Accurate Forecast Requires Years of Historical data

Lets dive in…

The Myth of One-Size-Fits-All Forecasts

The notion that a single forecasting method is sufficient for a product’s entire lifecycle is a widespread misunderstanding in demand planning. This idea fails to recognize the ever-changing nature of market landscapes and the varied demands of different products.

Just as a product evolves through various stages in its lifecycle, each stage presents unique demands that require customized forecasting approaches. Using a single, unchanging method throughout a product’s journey is ineffective, much like trying to navigate a constantly changing terrain with an outdated map.

The key lies in embracing flexible and dynamic forecasting methods capable of adjusting to shifts in market trends, consumer behaviors, and economic factors. Such adaptability is beneficial and essential for businesses to maintain a competitive edge in a constantly evolving market.

Different forecasting methodologies are needed at each stage of a product’s life, from launch to maturity and eventual decline. It’s much like understanding the changing needs of a product over time. Recognizing and applying these varied methods is essential for accurately predicting demand, helping to prevent practical issues such as inventory mismanagement or missing out on sales opportunities. This approach ensures that forecasting strategies stay relevant and effective, keeping pace with the fluid dynamics of the market.

Forecasting in the Face of Volatility

Addressing the second of demand forecasting myths, we tackle the challenge of forecasting products with unpredictable, low and lumpy demand patterns. This scenario presents a complex puzzle for demand planners as these irregular patterns don’t align with the consistent trends most traditional forecasting methods are designed for. However, this complexity does not make accurate forecasting an impossibility.

Advanced techniques like the Modified Croston method are specifically developed for these unpredictable demand scenarios. This method excels in environments where sporadic or non-uniform patterns, including periods of no demand, mark demand history. By examining the intricacies of demand fluctuations—identifying peaks, valleys, and plateaus—the Modified Croston method can uncover hidden patterns or use averaged trends to predict future demands accurately. This approach is especially useful for products that do not exhibit a regular demand curve, helping businesses to better align their inventory and resource planning with actual market needs.

The Power of Data in Forecasting

Dispelling another of the many demand forecasting myths, we address the belief that creating an effective forecast requires several years of historical data. While extensive historical data can be beneficial, accurate forecasting is optional. In many cases, if analyzed correctly, short-term data can be just as insightful for demand planning.

This is where the technique of attribute-based modeling becomes critical, particularly for forecasting new products, seasonal offerings, or products approaching the end of their lifecycle. This method examines a range of demand profiles created based on various attributes—such as product characteristics, regional preferences, or seasonal influences.

Assigning these detailed profiles to individual products and adjusting them based on early market feedback allows for precise and adaptable forecasts. This approach proves that effective forecasting can be achieved even with limited historical data by concentrating on relevant product attributes and adapting forecasts to reflect current market signals and trends.

Stochastic Planning: A Game-Changer for Intermittent Demand

Stochastic planning is a key strategy for managing intermittent demand, a common challenge in service parts inventory and wholesale distribution sectors. This method shifts from traditional deterministic forecasting to a probabilistic model. Instead of merely trying to predict demand, it evaluates the likelihood of various demand scenarios, making it ideal for handling irregular demand patterns.

Intermittent Demand: Using Stochastic Replenishment Planning

Companies face the perpetual challenge of managing items with intermittent demand patterns. Read more to gain a deeper understanding of Stochastic Replenishment Planning

Read the BlogThe approach encompasses three main areas: estimating the probability of demand occurrences, understanding lead-time distribution, and conducting a thorough risk analysis. It starts with assessing the likelihood of demand within a given replenishment lead time based on historical data, adapting to different demand patterns. This helps in preparing for varied demand scenarios.

Additionally, an accurate understanding of lead-time demand distribution is vital, which goes beyond customer demand variability to include supplier lead-time variation. Using statistical methods, planners can more accurately determine lead-time distribution, aiding in setting effective inventory policies.

Finally, stochastic planning requires evaluating risks associated with both understocking and overstocking, enabling planners to make informed decisions that balance inventory levels with demand, particularly for items with high margins or obsolescence risks.

Integrating DemandAI+ into Forecasting Strategies

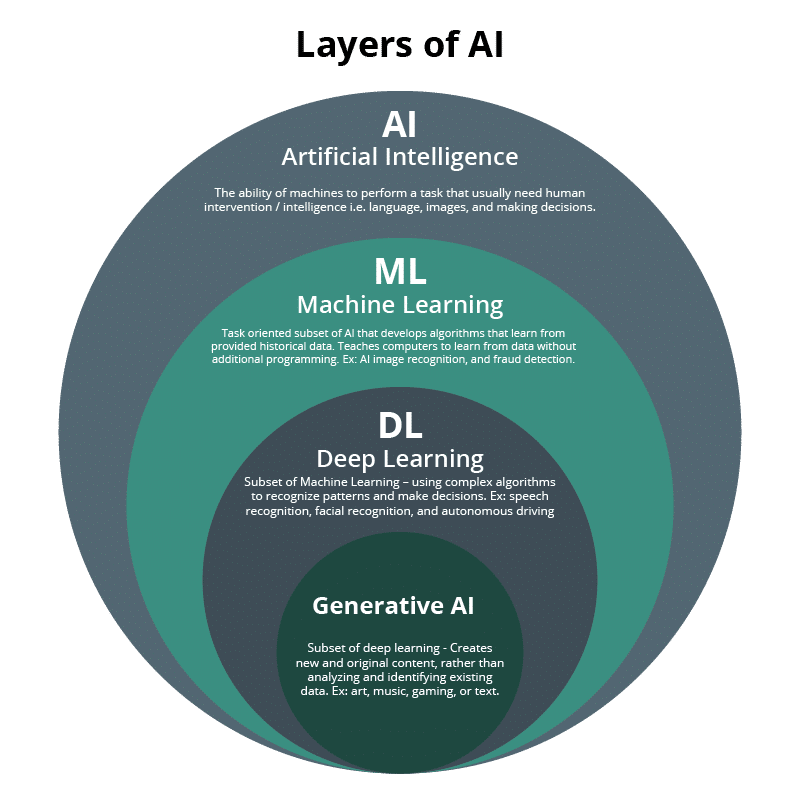

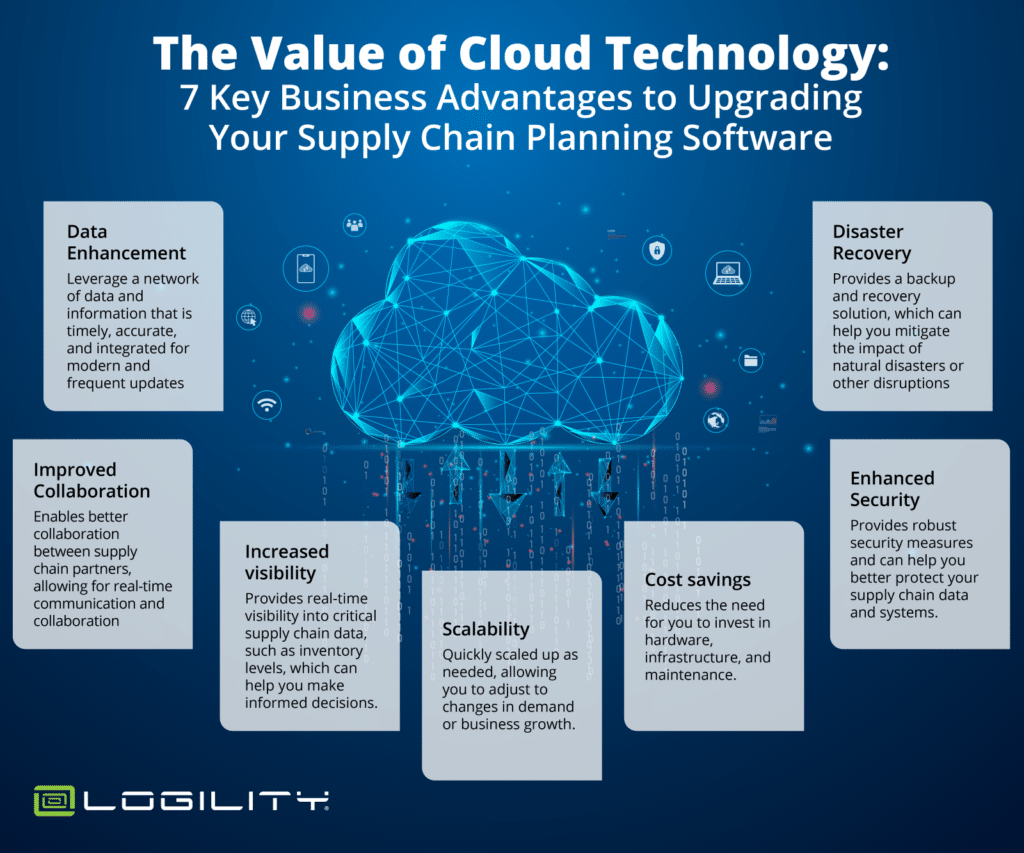

Logility’s DemandAI+ is an advanced solution incorporating these forecasting techniques to address the complex needs of modern demand planning. Using artificial intelligence, DemandAI+ enhances and automates forecasting, particularly for products with varying demand patterns.

DemandAI+ effectively integrates stochastic planning into its forecasting system, allowing for more precise predictions, especially for products with intermittent demand. The AI-driven system continuously learns and adapts to market changes, maintaining the relevance and accuracy of forecasts.

DemandAI+ simplifies analyzing extensive data and multiple variables that impact demand. It automates the selection of suitable forecasting methods for different product lifecycle stages and market conditions. This improves forecast accuracy and saves time and effort for demand planners, enabling them to focus on strategic initiatives.

Embracing Advanced Forecasting for Future-Ready Demand Planning

Traditional demand planning methods are no longer adequate for the current, fast-paced market. Our examination of common forecasting myths underlines the need for more flexible, innovative, and adaptable forecasting techniques. Advanced methods, including stochastic planning and tools like DemandAI+, are undeniably important for effective demand planning.

The future of demand planning requires a commitment to adaptation, innovation, and ongoing learning. Don’t let the demand forecasting myths hold you back. Moving forward, the successful integration of state-of-the-art technology and a comprehensive grasp of complex demand patterns will be vital for effective supply chain management. Now is the time to evolve our forecasting strategies to respond to market changes and actively influence our market position.