Supply chains face different challenges in growth versus recessive economies and must be managed to different company goals and objectives and different customer expectations. To complicate matters, unique supply chain challenges take place during transitionary periods between growth and recessive markets. Moving from growth to recession usually means issues involving too much, or the wrong type, of inventory, excess capacity and human capital, cash flow issues, and increased risk. Deep cuts in inventory, manufacturing, transportation, warehousing, not to mention people, that take place in recessions can make managing the rebound after a recession very difficult.

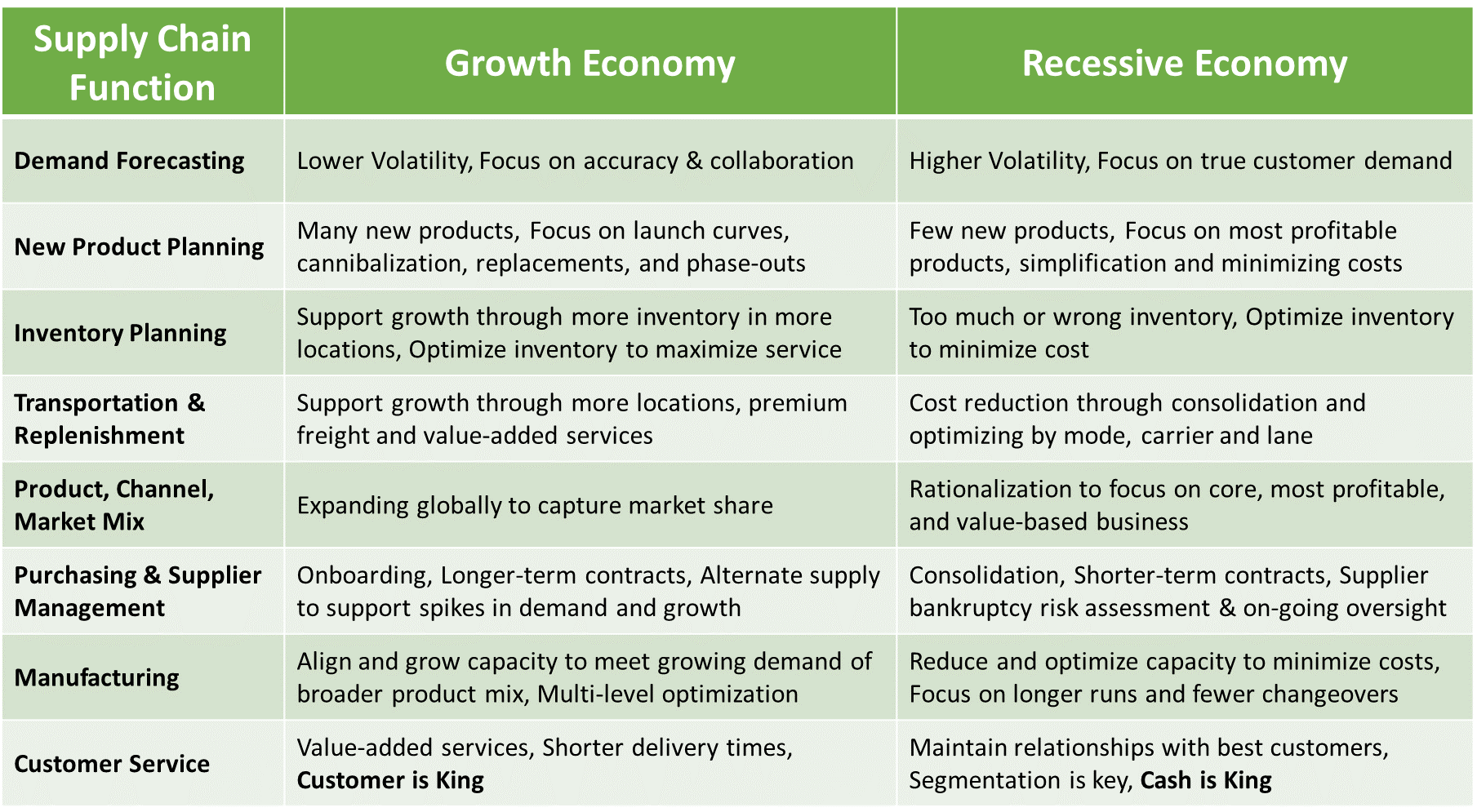

This post compares and contrasts the major challenges for each supply chain functional area during growth and recessive economies.

Demand Forecasting: During economic growth, product demand tends to have lower volatility and the demand planning function can focus on improving forecast accuracy through scrubbing outliers, algorithm fine tuning, incorporating new data streams as demand signals, internal and external collaboration, application of advanced technology, automation, multi-variate segmentation and the isolation and removal of bias—to name a few. During a recession, product demand tends to go through drastic changes, volatility increases and there is a widening gap between consumer demand (POS data) and customer purchase orders. Forecast accuracy can suffer based on your ability to leverage short term demand signals and a significant amount of effort is spent troubleshooting demand data and reforecasting. This is especially if your forecasting system doesn’t provide machine learning and artificial intelligence that can quickly ingest new data, adjust and refine future plans. A renewed effort is needed to get closer to true consumer demand to minimize the supply chain ‘whiplash’ effect.

New Product Introduction: During economic growth new products come fast and furious. Significant time is spent on new product launches including test marketing, sell-in and launch curves. There is also a considerable effort around cannibalization, replacement and phase out planning. For some industries where new products represent 30 to 50% of sales each year, new product planning can be all consuming. During a recessive economy fewer new products get introduced as companies try to conserve cash and reduce risk by focusing on their most profitable products. Planner priorities need to adjust to drive forecast accuracy of mature products to minimize production, transportation and distribution costs while maximizing revenues. You may also spend more time on product rationalization to streamline the overall product portfolio and put more focus on product differentiation and margin contribution.

Inventory Management: During growth it seems you can never have enough inventory. The focus is on servicing the customer and expanding market share. Inventory stocking locations and the total amount of inventory grows to support an ever expanding product offering into more distribution channels. Optimizing inventory to ensure high availability is more important than minimizing inventory investment. During a recession, companies are often caught with too much inventory in the wrong locations. This can be especially challenging for shorter life products. Often, consumer buying habits change favoring more value-based versus premium products and buying in larger quantities at club stores versus smaller pack sizes at convenience stores. Inventory optimization is still important, but in a recessionary market minimizing inventory investments outweigh maximizing customer service. At best, you should dedicate more effort to optimizing inventory at each location based on your recession-based business strategy and desired customer service level goals.

Transportation and Replenishment: During growth periods companies focus on supporting growth through more distribution and transportation capabilities. Additional distribution facilities are added to compress the time from customer order to delivery. Premium transportation services are used to meet ever-increasing customer delivery expectations. Value-added services multiply all supported by higher revenues and a focus on customer service. During a recession, the focus is on cost reduction through consolidation and optimization. Cash flow becomes the priority spurring a renewed focus on optimizing by mode, carrier, and lane. Consumers are willing to wait a bit longer for their products if they are able to get a better price.

Product / Channel / Market Mix: During long growth markets the number of products, distribution channels, and markets all expand to chase market share and expanding profits. Brick and mortar companies expand into e-commerce channels and vice versa and many companies expand into new domestic and international markets. These expansions consume significant supply chain resources to set up, plan for and operate new distribution facilities, lanes, products, and relationships. During recessionary periods companies tend to focus on their core competencies. Rationalization becomes key to understanding and focusing on the most profitable products, channels and markets. Prioritizing value-based channels and products to match with new consumer preferences is essential.

Purchasing and Supplier Management: Growth often requires additional suppliers. A focus on supplier onboarding and supplier capability management is key. Longer-term contracts are signed to ensure materials continue to flow. Alternative supply is established to ensure demand spikes can be met. To minimize costs and cash flow during recessions, there needs to be a focus on consolidating suppliers and shorter more flexible contracts. Supplier bankruptcy becomes a big issue requiring in-depth risk assessments, on-going monitoring and a renewed focus on contingency planning.

Manufacturing: During growth periods manufacturing operations are focused on aligning and growing capacity to meet growing demand of a broader product mix. A multi-level manufacturing planning focus on optimizing plant assignment and detailed scheduling of specific orders is needed to meet customer delivery requirements. Once again, customer service trumps financial considerations. During a recession the focus turns to reducing and optimizing capacity to minimize costs. A focus on mature, high profit products leads to longer runs and fewer changeovers helping to maximize product output and minimize costs.

Customer Service: During growth markets it is all about avoiding service failures, offering value-added services and accelerating delivery times to satisfy the customer and grow market share. The Customer Is King. During recessionary markets the focus is on maintaining good relationships with your most profitable customers. Multi-variate segmentation (both demand and supply) is a key capability to understanding what channels, markets and customers should be the highest priority. Cash Is King.

We are in this together. Remember, Logility is here to help.