Industry: Service Parts

According to Gartner, the typical company provides support services and parts for an average of seven years after an initial product sale, making service parts planning vital. It’s no wonder aftermarket parts and service areas have profit margins as much as 10 times those for initial product sales. Post-sale service is key to securing customer loyalty, fostering the company brand, and maintaining competitive differentiation. All told, aftermarket service and parts account for 20% to 30% of revenues and about 40% of total profits for most manufacturers.

There are multiple components to effective aftermarket service parts planning, including call centers, returns management operations, and promotions and marketing. However, the key driver of effective post-sale support is service parts management. Service parts management is the process of planning and alignment of service parts inventories, resources, and processes to ensure optimal customer service and response with minimal risks and costs.

Common goals for service parts planning include increasing forecast accuracy for service parts; reducing excess spare parts inventory; reducing obsolete spare parts inventory; enhancing scrapping programs; and increasing service levels by increasing fill rates, increasing product availability or up time.

While there are many challenges in achieving the goals stated above, there is one area that stands above the others. How can we do a better job of planning for products that have intermittent demand?

This white paper describes how Service Parts Planning and Optimization (SPP) is the linchpin of any effective service operation, and explains how to plan and align service parts inventories, resources and processes to ensure optimal customer service and response with minimal risk and cost.

Just think about the last time you brought your car in for service only to hear, that the part required to fix the problem was not available and had to be ordered from a central warehouse. It would take a few days at least. How how did you feel about that?

These things happen and aren’t uncommon. The result is, of course, an unhappy customer, likely looking for another service provider or third party. It may not seem like a big deal to the company, but it can snowball into one just by word of mouth.

The first example leads to potential loss of sales, which is difficult to quantify, unless your company keeps track of customer repetitive buys and/or inquires, which could be fulfilled directly. We know happy customers talk about his or her experiences to 4-5 people, but you can expect an unhappy customer to double that number.

The other factor to weigh in is additional revenue, which can be generated by improving customer satisfaction. There are simple metrics, which indicate the linkage between parts availability and additional sales. The rule of thumb says for every percentage point of service part availability, revenue grows ¼ of a percent. This is relatively simple to measure, and advanced inventory optimization makes it possible to optimize the service level based on customer and product segmentation.

A happy customer is more likely to return, and your wallet share also increases. According to research by Peter Kriss, the increase of customer satisfaction score from 7 to 8 in transactional business gives 30% more revenue per customer. Since after-market business mostly buys for need, the increase is smaller, but just think what would it mean for your operations, if you get 5% more sales per customer?

Another factor of revenue increase of customer satisfaction for the service parts business of an OEM (original equipment manufacturer) is the link between new product sales and service customer satisfaction. Remember, that the largest part of the lifetime of the product is the time when it is serviced. Ignoring aftermarket customer satisfaction also puts your new product sales at risk. Afterall, sales reliability and service quality is both in B2C and B2B; a very important factor in investment decisions.

It is time to start looking at your own services business from the customer perspective. It is already an unpleasant experience to unexpectedly need service, and missing the critical part to complete makes the experience more of a disaster.

The Linchpin to successful Service Operations

The key driver of effective post-sale support is service parts management. How can we do a better job of planning for products that have intermittent demand? Find out in this white paper

Get the White PaperLearn how you can get ahead of this curve and build an agile supply chain with a digital supply chain planning platform like Logility. Have you looked into inventory solutions? Read more about inventory optimization in this blog or download a free copy of our Executive brief: Rightsizing Inventory in a Cash Conscious Economy.

In June 2022, U.S. inflation reached a 40-year high. Although inflation has slowed since then, it continued to climb in January 2023, triggering fears that the Fed could keep raising interest rates throughout 2023. On the other hand, a slowdown in inflation could mean prices will gradually stabilize and we’ll avoid a recession.

What does all of this mean for manufacturers and distributors? In times of economic uncertainty, there’s one thing for sure: supply chain leaders must be able to pivot quickly.

Inflation and labor issues are squeezing margins. Higher interest rates and materials prices are increasing the costs of carrying inventory. And rapid shifts in market demand always leave someone holding excess inventory.

In short, there’s intense pressure on supply chain practitioners to do more with less. Here are three ways to protect your margins by enhancing your supply chain network design.

1. Use a digital twin to rapidly analyze new supply chain network design scenarios

A digital twin is simply a simulated version of your real-world supply chain. As you seek to optimize your supply chain, you’ll need to run multiple scenarios that project the impact of each decision. Should you explore nearshoring or friendshoring? Add more distribution centers? More micro-fulfillment locations?

With the right supply chain network design solution, you can evaluate many scenarios in minutes. Logility NDO enables you to improve your resiliency by continuously assessing tough tradeoffs between sourcing and distribution options, lead times, and logistics costs. By rapidly prototyping your supply chain scenarios, quantifying your costs, and measuring the impact on service, you can make responsible decisions that take all factors into account—which is increasingly important in an age of heightened scrutiny on corporate social responsibility.

2. Detect market shifts with demand sensing

The goal of demand sensing has always been to do better than traditional forecasting at short-term planning. The theory is that if the mid- to long-range past is the best predictor of the mid- to long- future (as is the belief in forecasting), then the immediate past will also be the best predictor of the immediate future.

That theory generally worked well—until the pandemic. Is there a supply chain stakeholder anywhere in the world right now who’s willing to use data from 2020-22 to project demand during 2023-25?

We can project the immediate future and detect market shifts, but we’ll have to think outside the box. We should all strive to:

- Build a foundation by incorporating data on trends such as housing starts, demographics, and Amazon and Google activity. This is where we must venture outside our own databases and see what clues we can gather from various corporate and government sources. A surge in housing starts may indicate there will be strong demand for the carpet staples you supply. A flurry of Google searches for “do it yourself car repair” may change your strategy as an automotive parts supplier.

- Enhance the accuracy of demand volatility forecasts by adding in causal factors. Causal factors are contributors to a particular event or outcome. Unlike the data from the ebbs and flows of trends mentioned above, some causal factors can manifest as drastic changes such as extreme fluctuation in channel inventory, unusual weather conditions and severe weather events, natural disasters, and health crises (such as future waves of a pandemic).

- Bring these insights into your sales and operations planning. Don’t stop at asking your planners to plug causal factors into their forecasts to generate a wider range of results. Make sure all your stakeholders are considering these insights as they formulate strategies for balancing demand, supply, and service levels. You’ll enable them to protect your margins and reduce working capital.

3. Evaluate alternative suppliers

According to a recent KPMG survey, 71 percent of global companies highlight raw material costs as their number-one supply chain threat for 2023. It’s not hard to see how higher costs will increase supply chain complexity. More and more manufacturers will aim to control costs by casting a wider net for suppliers. As formerly alternative suppliers become major players, their own supply chains will inevitably dry up—leading manufacturers to search even harder for alternatives.

Amid all this searching, how confident are you in your company’s ability to evaluate alternative suppliers quickly and accurately? And how will you optimize supply planning as your supply chain becomes an increasingly complex web? You can use forward-looking lead time analytics to identify areas of latency and identify appropriate remedial actions such as alternate shipping, alternate production, or creative sourcing solutions.

Learn more about supply chain network design

The supply chain environment is changing too quickly for you to wait months for a supply chain network design solution to go live—only to spend months more customizing your new solution. That’s why Logility taps into a history of innovation to recommend the exact set of solutions that will add the greatest value to the operations of each client. We then use a highly agile, prescriptive implementation approach to deliver value in weeks.

Contact us to learn more, or see Logility NDO in action.

The Science and practice of predictive analytics is well established and rapidly gaining ground in the public and private sectors. It’s no longer considered magic because we now have advanced analytics systems that harness and organize massive amounts of disparate data and model that big data in ways that allow humans to be proactive and make informed decisions.

How would your supply chain decision-making be enhanced if you had the power to harness the data of the past into decisions for the future using predictive analytics modeling?

What are Predictive Analytics for Supply Chain?

Predictive analytics encompasses a variety of statistical techniques from predictive modeling, machine learning, and data mining that analyze current and historical facts to make predictions about future or otherwise unknown events.

Predictive models exploit patterns found in historical and transactional data to identify risks and opportunities. These models capture relationships amongst many factors to allow assessment of risk or potential associated with a set of conditions, guiding decision-making with better accuracy and significant cost savings.

How can big data lead to supply chain optimization?

Let’s examine two popular applications: supply chain optimization and baseball. How can predictive analytics effectively address these seemingly unrelated topics? Because at a macro level the issues are identical. Consider this abbreviated chronology of our quest to make better, faster, data-driven decisions regardless of the setting and the objectives:

- We had no data. We used unstructured observations and gut feel

- We got some data, but it was incomplete and resided in silos

- We got more (and more comprehensive) data, eliminated silos, filled in the gaps, but lacked modeling tools. This was the era of data-rich but information-poor, the big data conundrum.

Today, predictive analytics tools allow us to compare possible outcomes of events using scenario analysis and foresee challenges and potential disruptions before they happen.

Supply Chain Optimization – Use Case for a Domestic Brewery

Our supply chain optimization use case comes from a top-10 domestic brewery that used Logility’s predictive analytics capabilities to gain better insight into production. Before Logility, this brewery had plenty of data, but was unable to make sense of it and “make it tell us something useful about the future”. Sound familiar?

The data needed to be more easily translated into actionable information for managers and executives. The company had a variety of tools in-house, but the fragmented technical environment was too difficult to manage for quick scalability. They needed a powerful, analytics-driven solution to integrate and transform the data from their disparate systems, along with a front end for visual analytics, designed for the specific challenges of the beverage industry.

A key point of differentiation for Logility was the ability to link multiple data sources to a single supply chain planning platform with reporting and analytics capabilities built into the functionality. Logility’s rapid integration framework enables a one-time setup of the platform, followed by easy report creation and access to predictive analytics by business users. An early win included creating a daily shipments and depletions report for the CFO. Using a mobile-ready interface, the CFO can quickly scan variances each morning and immediately drill down to SKU and account-level data to see what’s driving exceptions.

Based on these early victories, the brewery believes that the early detection of production efficiencies will yield up to $800,000 savings within the first 18 months. In addition, the company points to a two FTE reduction (about $300,000 annually), and faster decision-making by business managers.

The Baseball Analogy

Now let’s consider the case of building a winning team in baseball, and the use of sabermetrics. The premise of sabermetrics is that the historically most common measure of performance, the runs-batted-in percentage (RBI), was an incomplete measure of the likelihood that a team would win a championship. Baseball statisticians, now called “sabermetricians”, have figured out how to use all the available data on a player’s performance to make a better decision on which players to combine onto a team. This is a great example of predictive analytics applied to baseball.

You may have seen this portrayed in the movie “Moneyball”, where the proponent of sabermetrics was trained in economics and computer programming, was arguing for the managers of the baseball team to try a different and more scientific approach. The sabermetrician focused on a new metric: On Base Percentage (OBP). The sabermetrician found that getting on base by any means is foundational — you cannot be batted in if you are not on base. Sabermetrics Identified the first link in a chain of causal events that lead to success: focus on getting on base by any means including walks and being hit by the pitcher.

Even more important, the Moneyball sabermetrician knew that decisions on which players to recruit and who to trade were constrained by budget and availability. With other teams pursuing recruits with the highest RBI statistic, the sabermetrician knew there was an arbitrage opportunity — recruit older players with high OBP, even if they were near the end of their careers and being traded away by other teams because their RBI statistic had dropped off.

The dominance of sabermetrics in modern baseball is analogous to how big data and advanced predictive analytics is now coming to dominate modern supply chain optimization. Combining more and more data into a large ecosystem affords a broader analysis space, leading to new insights that would never be found if the data processing were not blended and automated. Identifying conditions that have a larger-than-average value multiplier (arbitrage) is more powerful when the search for arbitrage is informed by big data. And in both baseball and supply chain management, you need financial metrics in order to choose the best strategy.

As you can see, predictive analytics and the underlying tools that support the discipline can be applied in many settings. People like to solve problems, but they need the right information. As business leaders we need to make sure they have it and then set them free.

Measuring the Value of Optimized Inventory in Service Parts

The spare parts market is big business, with the global automotive spare parts market valued at US $160.69 billion in 2021 and projected to grow to US $264.68 billion by 2030. It is a complicated, availability-driven industry, but the prize for getting inventory distribution right is significant.

In a well-known study by behavioral scientist Peter Kriss entitled ‘The Value of Customer Experience Quantified’, he concludes that higher customer satisfaction from a better fulfilment experience can increase revenue by 1.4 times per customer. Simply improving the availability of A class parts by 3% directly contributes over 1%–2% to your top line. It also increases the chances of keeping that customer when they go back into the market for a replacement model by up to 21%.

“Logility has helped us achieve remarkable results including improved service levels, greater visibility and faster inventory turns.”

Lars Blomberg, VP Planning and Control, Sandvik

Plan Strategically Across All Spare Parts Planning Horizons for Improved Outcomes

Planning and managing service parts inventory is challenging as it requires keeping a small quantity of many unique items at any given time, creating a long tail across all product lifecycle stages. Low volumes and lumpy demand mean a standardized forecasting approach is inadequate; overstocking can lead to high carrying costs and obsolescence, and understocking can lead to stock-outs, spot buys and expediting charges.

And the complexities of coordinating multiple systems, DCs and suppliers across broad geographies is made more difficult without a single, integrated system that provides visibility across the extended spare parts supply chain.

For effective service parts planning across different horizons, you must understand the level of customer service you want to achieve, how much inventory that will take, and how you can minimize costs. This can be achieved through forecast-driven stocking strategies and a supply chain designed and configured for efficiency.

In their parts logistics division for example, Logility customer British Petroleum (BP) “fixed customer service” by improving forecast accuracy by 10%, in turn reducing back orders by 150%.

When planning for the short term, an allocation engine that already understands product and customer priorities can apply that information to inventory available and in transit. For delayed and constrained supply, scenario planning enables manufacturers to explore how various constraints will impact customer service.

“Covid-19 had a huge impact in the automotive industry. Together with Logility, we were able to quickly assess impacts by creating and reviewing scenarios based on the disruptive market signals. Using the native AI capabilities in Logility, we were able to offset the impact of the disruption and meet the increased demand and prevent reduced service levels.”

Marco Turk, Demand & Inventory Planning Manager, DENSO

When planning for the medium term, an effective sales and operations planning (S&OP) process can minimize gaps between sales orders and shipments. Inventory optimization eliminates stockouts and delays with strategic inventory replenishment at distributors, retailers and service centers. And a better understanding of product behavior can mean your ABC product mix and stocking strategy can better align with how those products behave in the market.

For longer-term spare parts supply chain planning, you need to be able to understand whether your service level goals can even be achieved with your existing supply chain network as designed. Modeling your supply chain to determine how many days customers are waiting for a product can facilitate better decision-making around your suppliers, transport flows and distribution network.

“The greatest single contributor to customer satisfaction – where aftermarket service is a factor – is the availability of the necessary parts to service the product.”

Aly Pinder, Program Director, IDC

Inventory Optimization Solutions That Meet Spare Parts Business Goals

Logility provides a digital supply chain platform that lets you visualize and co-ordinate your supply chain end to end. You get the visibility and data-driven insights you need to optimize your inventory while protecting and preserving your customer relationships and your margins. Contact us today to discuss ways to increase margins and improve service levels with an optimized spare parts supply chain.

Why do we build logistics models?

This is obviously a rhetorical question. But I ask it because modeling often takes a detour into the land of debilitating detail. And by debilitating, I mean an enormous analytical time sink — think months. I am often asking clients whether they wish to:

A) Model the precise general ledger costs for logistics?

or

B) Make a well-researched decision?

If you chose “A” you can stop reading because the rest of this blog post is about why that will lead you down the wrong path.

At the surface “A” and “B” seem to follow one another. If I am making a good model, am I not accurately modeling my future logistics spend? Yes, with a big BUT… the precision required to make a perfect model of your financial spend can often lead you to a create a model that is erratic. Let us look at this a little deeper and see where the “precise” and the “good” deviate in a classic logistics model.

What is a Good Logistics Model?

A good logistics model is designed to predict the future. Yet a modeler will always start with a calibrated baseline. And the “calibrated” part of this refers to accounting costs — those costs found in an organization’s financial database. The theory goes that if a model shows the same costs as the current state, then we can trust that it will show appropriate differences when changes are modeled.

A logistics model can be as complex or simple as a modeler wishes, however it always needs to be believable and grounded in the actual costs of a system. This blog post should make one thing clear to the modeler: the search for “accounting” level accuracy can stand in opposition to your actual goal — making a supply chain decision. It will not only cost you time to build this “perfect” supply chain model, but it will also imbed imperfections into the very mechanism of the model.

What Makes Fiscal Accounting Accuracy Popular?

People gravitate to their accounting numbers because of comfort — pure and simple comfort. General ledgers do not need to be explained. They reflect actual expenditures — they are immovable facts of history. They are also safe. Executives and managers alike believe their general ledgers. No one gets sent out of a conference room for repeating known accounting numbers to a group. But the actual spend last year has lots of little aberrations.

How Can Accounting Costs Lead You Astray?

Accounting costs can look very detailed and accurate; take an entry for an individual shipment of your product, for example. You can see the units, weights, and most importantly, the costs. These costs go directly into the accounting system. These show exactly what was paid net of discounts, accessorial, and anything else that might be tacked on.

This means that for every origin and destination that has shipment activity, we should have a highly accurate cost for the organization’s shipment down that lane… right?

Let me share experience from hundreds of modeling exercises. If we treat a shipment table as the definitive cost for each lane, we run into three problems with our model:

1. Lack of statistical significance

2. Heterogeneous data

3. GAAP accounting methods

Let’s delve into each one of these.

1. Statistical Significance — If I have a number, how can it be wrong?

Let’s say you have data on hundreds, or even thousands, of trucks you paid for last year. How could this vast amount of real data go wrong? When you break them down by lane, season, and method of purchase, thousands of data points might turn into five to ten data points for a given lane — or sometimes only one shipment. As a reminder from that long-forgotten statistics class, statistical significance for a single variable starts at seven data points — just to be roughly correct.

Now go further and ask yourself:

– Does your shipment data have a mix of spot and contract shipments?

– Are there data points for every season? Note: trucking in some regions has significant seasonality.

– Is there selection bias? Your buyers or your 3PL might be taking advantage of opportunistic contracts— trucks that were cheap for a single event, but do not reflect the market price next year.

You may have a wealth of data in aggregate but not at the level you need. Here is a way to test its value to a model — take a sample set of data for a given region and given season. Find the average and standard deviation by individual origin and destination. The variation will probably be large — I base this on my experience. The danger is that this variation is dropped from analysis once the average is found. Do some statistical sniff tests, you will probably be very disappointed in the value of this data in predicting your future spend on a lane-by-lane basis.

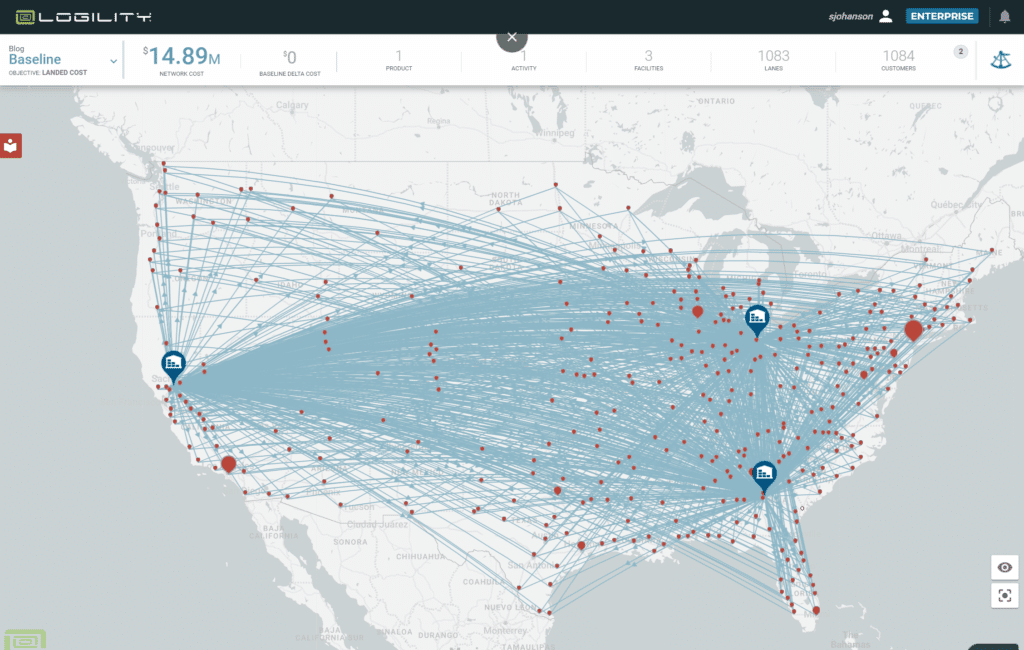

Figure 1 below visually displays what historic data looks like in an actual model. The total cost of the network exactly matched the accounting cost of $6.97MM. You can see three warehouses and almost every warehouse shipped to each destination city. We should have lots of real historical date, no need to fill in the blanks.

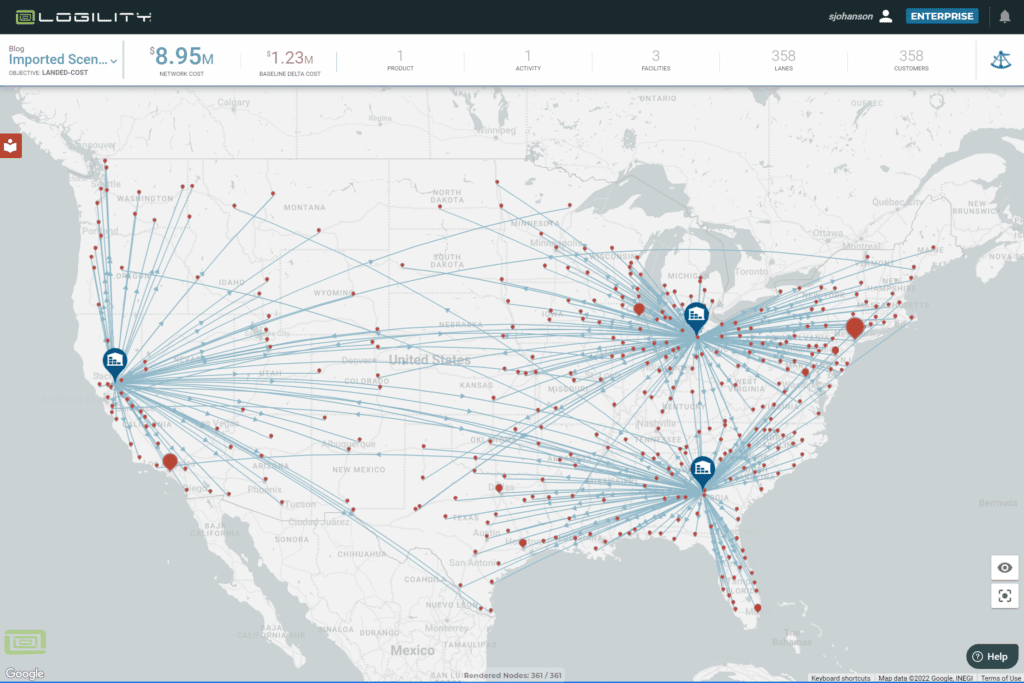

Here is where it goes wrong, Figure 2 is the same data set but optimized for the lowest cost supplier. Great, see how I saved $948K? Now look closely, find all the crisscrossed lines. Find the case where a customer node is right near the Alabama warehouse but is shipped from the Nevada warehouse.

If it was not obvious before, you should now realize that optimization software acts like a passive aggressive child. If it can follow your instructions exactly and return nonsense, it will. In this case the analyst could go to each lane that did not make sense and exactly match it to actual average truck costs. Our wealth of data falls apart because lack of statistical significance throws off our model — we cannot rely on hundreds of records that present a solid average and we have not even started to add lanes that do not have any historical data.

2. Heterogeneous Data — how do you fill in the blanks?

The purpose of a logistical model is to answer “what-if” questions. This means something is going to change — a new port, new warehouse location, new route to the customer. Inevitably, key transportation lanes will not be found in the historical data. Modelers generally use three methods: quotes from carriers, regression analysis, and benchmark (market) data. Each of these methods will create three very different sets of data.

Carriers can provide quotes on contract and spot rates for a defined set of lanes. These will not match your historical costs because the carrier is predicting the future costs at the same time they are trying to secure your business. Many things might not match your past discount rates and accessorial charges. But with effort and enough quotes, you can get these to be “OK.” It will take time and you will have to do it every time you make a change in the model.

Regression analysis will turn a pile of data into a statistically significant formula. But it will also have inherent errors. Truckload rates are not uniform across any geography. An extreme example would be a port city like Los Angeles; more loaded trucks go out of Los Angeles than in. You will find that the cost from Phoenix to downtown LA is 42.5% the cost of a truck from LA to Phoenix. This is an extreme example, but you get the idea – regression formulas average out a lot of market subtleties.

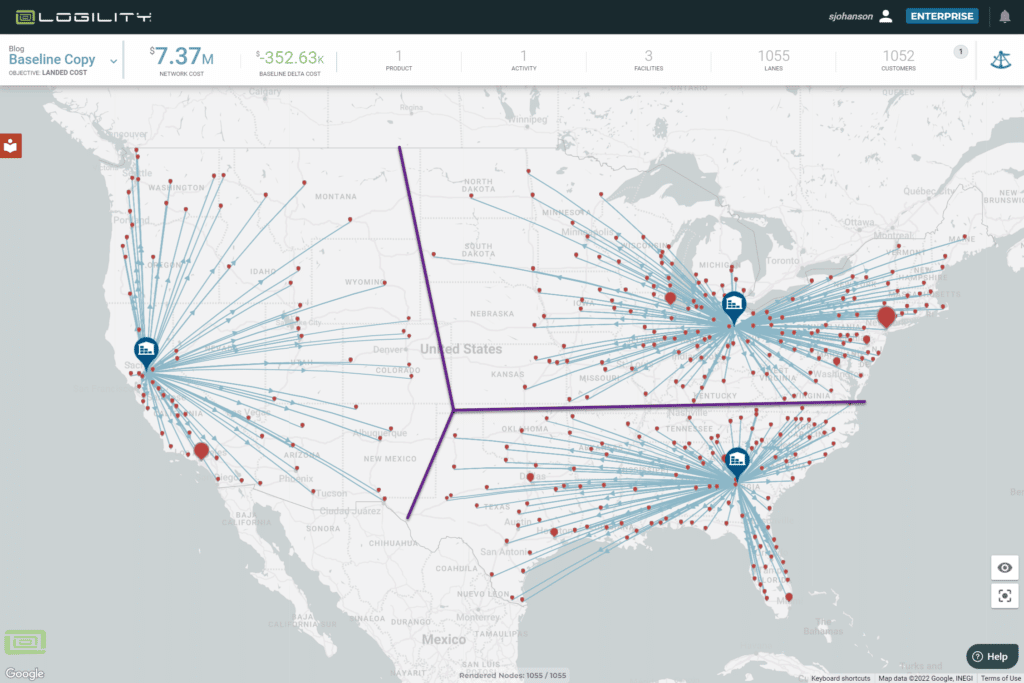

Figure 3 is an example of regression data input into the model. It makes the pretty picture you want to see — every customer is served out of its nearest warehouse. You can see the purple line showing the smooth lines of demarcation between service areas. This is easy to explain but is not correct.

The third data set is benchmark or market data which is really another measure of historic data, but it has the advantage of being historic data across hundreds of companies and millions of shipments. It will not match a company’s historic data precisely. But if everyone is buying from the same market you can assume that everyone’s rates will regress to the same market average.

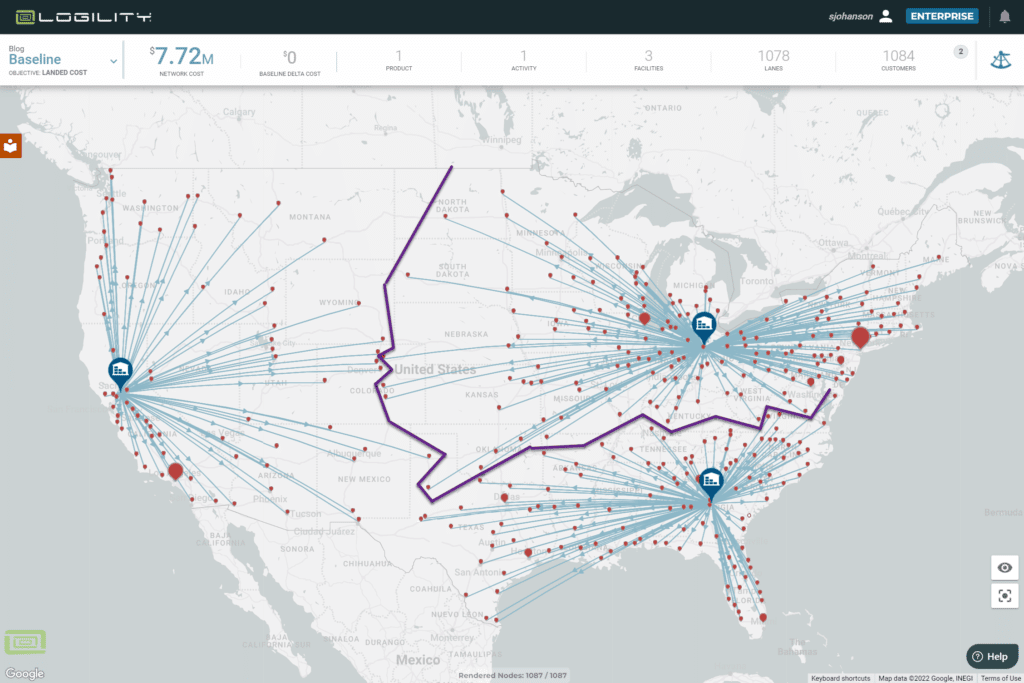

In Figure 4, you will see the customer-to-warehouse assignments are not as clean as the regression. But this is the real world and reflects the optimum use of the freight market. For example, trucks from Illinois going south are cheaper per mile than Alabama going north and east. This may be harder to explain to someone with this picture, but it has the advantage of being the most right.

Benchmark data also has the advantage of being the same set of data for known and unknown lanes You do not have to create a Frankenstein-like data model of mixed sources to fill in all the data you need.

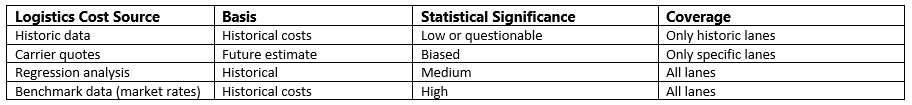

See the table below to describe the usefulness of different data sources.

Combining two or more sets of heterogeneous data across thousands of lanes requires a miracle of analysis to get them coordinated to the point that they do not mislead your analysis.

3. Cost Accounting — How can my numbers be wrong when they match my P&L?

Accounting is for accountants. Their objective is to balance all account totals at the end of each period. There are a lot of ways that transportation invoices are reconciled to their actual costs inside this time frame. These include corrections that might be taken at different times than the actual shipment or include discounts either ascribed to a shipment or again taken at a different point in the period.

Manipulating all the costs, corrections, and discounts to match each shipment can be an enormous task. If you total all the truckload, LTL, and Parcel shipments into a subtotal by mode, you can believe that summed number. However, if you want each of thousands of individual shipments to be properly costed, you have a lot of work to do and might need to get your accounting department to spend some quality time on your project.

What Should I Be Doing Instead?

The way to build a good supply chain model is to rely on long-term market figures and averages. You can buy them from any number of rate boards or Logility provides its own proprietary data set with its SaaS subscriptions. All you need do is calibrate these numbers to your business by “benchmarking” them against what you do know. Scale the market rates up or down and proceed to answering your question.

The true value of a logistics model will be that it trades off high-cost modes like LTL against low-cost modes like FTL. Or that inventory will be traded off against transportation. As long as your ratios are calibrated, you will get the right answer. And a good supply chain leader will value the right and defensible answer over detailed accounting precision — and they will appreciate that you answer the question sooner rather than later.

Additional reading:

Every business ‒ regardless of size, industry, or market ‒ can relate to the same challenge: customer frustration. It’s incredibly complicated to pinpoint when an order will ship and when it will arrive. Components and raw materials are still in short supply, logistics services remain delayed, and demand shifts and shocks are consistently unpredictable. Customers are looking for answers.

For Johnson Controls, a significant component of the answer begins with being capable to plan and turn those “plans” into customer promises.

During this year’s Gartner Supply Chain Symposium, Hamish Scrimgeour, Global Director of Planning and S&OP at Johnson Controls, shared how his team is perfecting its ability to plan by converging and integrating business systems to orchestrate the supply chain across multiple global sites.

“We all need to aspire to improve supply chain planning. There’s no way you can orchestrate a value stream until you’ve got it all integrated,” Scrimgeour said. “We must think outside the site and move the supply chain as a single network.”

Change Fuels the Need to Do Things Differently

It’s well understood that the supply chain operations of the past, for the most part, have been good – but there’s always room for improvement. As the dynamics of supply and demand continue to evolve, businesses need to find ways to adapt quickly and pivot resources intelligently. And solutions and systems are part of that change.

Even though Johnson Controls is more than 150 years old, it has the heart of a young startup. Through its comprehensive digital portfolio OpenBlue, Johnson Controls offers seamlessly integrated products and solutions in building automation, building controls, refrigeration and air conditioning, as well as security, fire protection and fire suppression. The pure play smart sustainable buildings company is always focused on innovative solutions that make things smarter, safer and healthier, as well as more cost-effective, sustainable, and secure. That trait is what Johnson Controls is all about, whether designing a new thermostat or redesigning internal processes.

Serving 4 million customers in 150 countries with a global team of 100,000 experts across more than 100 locations (manufacturing sites and distribution centers), Johnson Controls’ ability to plan is critical. Its products and solutions are sold in commercial and residential markets to B2B and B2C buyers across six continents, presenting unique customer expectations, go-to-market strategies, and planning challenges.

“We have the entire gamut of manufacturing strategies,” remarked Scrimgeour. “Depending on the product design and customers, each subsidiary plans differently in little ways to address, for example, production scale, demand horizons, material risks, and customer value that is unique to them. And with an annual multi-billion spend on 6,000 vendors, approaches may vary based on the supplier’s size.”

Despite all these differences, Johnson Controls chose to integrate supply chain planning. Scrimgeour recounts the line of thinking behind the decision: “We’ve been using Logility solutions since 1997. But when our merger with Tyco, also a Logility customer, was completed in 2016, we saw a great opportunity to integrate the planning technology, processes, and data between the two companies.”

Transformation Begins with Convergence

Businesses cannot run 60 ERPs and expect to be on the same page – the same is true when every subsidiary has its own approach to demand and supply planning. But that was the situation that Johnson Controls wanted to change for itself.

“Converging all these ERPs and solutions is a big effort; however, it’s the best way to tie our supply chain planning across the entire business,” Scrimgeour said. “Every subsidiary and business unit has different requirements. But all of us agreed to enhance and continue working with Logility with a vision for end-to-end supply chain planning that was transparent, orchestrated, and optimized.”

The first step of the transformation focused on demand planning. The three-step process of booking, releasing, and building products is managed by one planner. Johnson Controls used Logility solutions to advance its supply chain planning processes from a demand perspective, encompassing capabilities for forecasting orders, tracking and tracing products, and identifying value-added opportunities.

The company also added a twist to this digital initiative – revenue recognition. In most cases, companies produce a widget and get revenue from it immediately after the purchase transaction. Johnson Controls’ engineer-to-order model, on the other hand, recognizes revenue in milestones throughout the building process, which means the value of every order must be monitored along the way.

As Johnson Controls moves further in its transformation, its planners will be able to forecast the workflow, timeline, and milestones for orders ahead of time.

“That’s one of the game changers this initiative with Logility will bring over the next few years,” highlighted Scrimgeour. “Getting orders booked, released, produced, and delivered requires much more than execution excellence. A large variety of parts, manufacturing strategies, and marketing programs must be managed seamlessly.”

In addition to elevating its demand planning, revenue recognition, and supply forecasting capabilities, Johnson Controls is balancing its inventory more effectively. The company has gained greater visibility into on-hand inventory across its distribution centers, with the assistance of its data analytics partners. Now, it can compare order trends with inventory quantities to better fill demand and optimize production capacity. Scrimgeour expects that distribution centers will be stocked with the right mix of stock and units based on demand close to them.

“Everyone Knows Where Everything Fits”

Johnson Controls is a prime example of the true potential of integrated planning. The company is motivated to cover all aspects of its supply chain planning processes across all value streams and manufacturing systems. But more importantly, employees can work together more collaboratively, intelligently, and strategically – irrespective of their subsidiary. The company sees it as a chance in a lifetime to be really at the foundation of redesigning supply chains that are going to be much more resilient, focused on ESG, and ultimately achieving “what we are all setting out to achieve.”

Contact us today to learn more about integrated planning and the Logility Digital Supply Chain Platform.